SSA Annual Updates

Find up-to-date information on the rates that SSA sets annually.

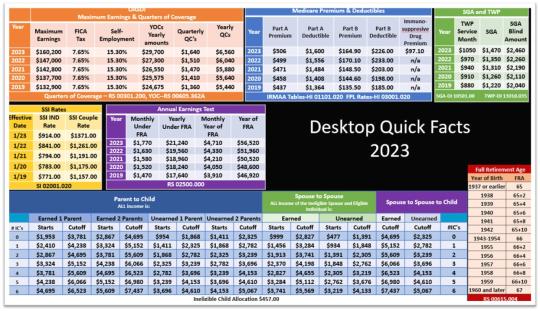

SSA Desktop Quick Facts 2023

Instructions for using as your Desktop Background (DOCX)

Supplemental Security Income (SSI) (2024)

| Individual | Couple | |

|---|---|---|

| Federal Benefit Rate | $943/month (2023: $914) | $1,415/month (2023: $1,371) |

| Resource Limits | $2,000 | $3,000 |

Substantial Gainful Activity (SGA) (2024)

| Non-Blind | Blind |

|---|---|

| $1,550/month (2023: $1,470) | $2,590/month (2023: $2,460) |

Trial Work Period (2024)

| Trial Work Period | Minimum earnings before a month will count as trial work month for SSDI beneficiaries: $1,110/month (2023: $1,050) |

|---|

Student Earned Income Exclusion (2024)

| Monthly Limit | Annual Limit |

|---|---|

| $2,290 (2023: $2,220) | $9,230 (2023: $8,950) |

Social Security Credits (2024)

| Earnings to Qualify for Credits | Credits needed for Disability Benefits* |

|---|---|

|

$1,730/ one quarter of coverage (QC), (i.e., "credit") (2023: $1,640) Up to a max of $6,920/ four credits (2023: $6,560) |

|

*How many credits you need for disability benefits depends on how old you are when you become disabled.

Medicare Costs (2024)

| Part A | Part B | Part D | |

|---|---|---|---|

| Premium |

Either $278 or $505 depending on how long you or your spouse worked and paid Medicare taxes. (2023: Either $278 or $506) Most people don’t pay a premium because of Medicare-covered employment. |

$174.70/month (2023: $164.90) if 2022 income was less than $103,000 (individual)/$206,000 (joint) | Base premium (depending on plan) plus an Income Related Monthly Adjustment Amount (IRMA) ranging from $12.90 - $81.00/month if 2022 annual income was above $103,000 (individuals)/$206,000 (joint filers) |

| Deductible | Hospital inpatient: $1,632 (2023: $1,600) for each inpatient hospital benefit period before Original Medicare starts to pay. | $240/year (2023: $226) before Original Medicare starts to pay. | Varies by plan and pharmacy. |

Medicare Savings Programs - Income and Resource Limits (2024)

| QMB Qualified Medicare Beneficiary |

SLMB Specified Low-Income Medicare Beneficiary |

QI Qualifying Individual |

QDWI Qualified Disabled and Working Individual |

|

|---|---|---|---|---|

| Monthly Income Limit* | Individual: $1,275 Couple: $1,724 |

Individual: $1,526 Couple: $2,064 |

Individual: $1,715 Couple: $2,320 |

Individual: $5,105 Couple: $6,899 |

| Resource Limit | Individual: $9,430 Couple: $14,130 |

Individual: $9,430 Couple: $14,130 |

Individual: $9,430 Couple: $14,130 |

Individual: $4,000 Couple: $6,000 |

*Income limits slightly higher in Alaska and Hawaii

Continued Medicaid Eligibility (1619(b)) Thresholds (2024)

| State | Threshold | State | Threshold |

|---|---|---|---|

| Alabama | $37,246 | Montana | $44,272 |

| Alaska | $86,438 | Nebraska | $52,190 |

| Arizona | $53,159 | Nevada | $41,941 |

| Arkansas | $38,551 | New Hampshire | $45,194 |

| California | $58,638 | New Jersey | $51,902 |

| Colorado | $52,578 | New Mexico | $48,855 |

| Connecticut | $54,293 | New York | $59,826 |

| Delaware | $50,146 | North Carolina | $43,307 |

| District of Columbia (DC) | $54,775 | North Dakota | $53,007 |

| Florida | $36,734 | Ohio | $40,936 |

| Georgia | $35,761 | Oklahoma | $42,494 |

| Hawaii | $49,781 | Oregon | $42,955 |

| Idaho | $47,643 | Pennsylvania | $50,536 |

| Illinois | $38,906 | Rhode Island | $41,109 |

| Indiana | $39,153 | South Carolina | $39,557 |

| Iowa | $45,246 | South Dakota | $43,595 |

| Kansas | $44,316 | Tennessee | $34,490 |

| Kentucky | $45,921 | Texas | $50,161 |

| Louisiana | $38,748 | Utah | $46,961 |

| Maine | $48,959 | Vermont | $40,339 |

| Maryland | $52,892 | Virginia | $45,976 |

| Massachusetts | $44,965 | Washington | $57,954 |

| Michigan | $43,228 | West Virginia | $35,216 |

| Minnesota | $74,611 | Wisconsin | $46,545 |

| Mississippi | $37,847 | Wyoming | $42,527 |

| Missouri | $44,287 |

Resources

Links

Details

- Type:

- Article

- Date:

- March, 2022

Other Details

- Topic

- SSA Information